How Brands Reduce Payment Risk in Influencer Campaigns

Learn how brands reduce influencer payment risk using escrow payments, fraud prevention strategies, and AI powered workflows to protect ROI and build trust.

December 24, 2025

Influencer marketing has evolved into a core growth channel for modern brands. But as budgets increase and campaigns scale, one challenge continues to surface across the industry: influencer payment risk.

From creators failing to deliver agreed content to disputes over performance, fraud, or inflated metrics, payment risk has become one of the most underestimated threats in influencer marketing. Studies consistently show that influencer fraud and lack of verification lead to wasted spend, damaged trust, and lower ROI.

For brands that want influencer marketing to function as a predictable revenue channel, reducing payment risk is no longer optional. It is an operational requirement.

This article breaks down how brands reduce influencer payment risk today and why escrow based payment models, real attribution, and automated influencer operations are becoming the new standard.

What Is Influencer Payment Risk

Influencer payment risk refers to the financial exposure brands face when payments are released without guaranteed delivery, verified performance, or clear accountability.

Common forms of risk include creators not publishing content on time, content that does not meet brand guidelines, fake engagement or inflated followers, disputes after payment is released, and fraud related to misleading endorsements.

Academic research on influencer fraud shows that consumer trust and brand credibility decline significantly when fraud or misleading influencer behavior is perceived. In many cases, brands only discover these issues after payments have already been completed.

Once funds are released, recovery is difficult, time consuming, and often impossible.

Why Influencer Marketing Fraud Amplifies Payment Risk

Influencer fraud directly increases payment risk because it distorts the signals brands rely on to make decisions.

Research analyzing influencer fraud and perceived credibility confirms that brands frequently fail to identify fake influencers before entering partnerships. This leads to payments being made based on misleading reach, engagement, or authenticity.

The problem is not limited to fake followers. Fraud can also include undisclosed sponsorships, misleading claims, reused content, or creators failing to disclose paid partnerships properly.

When payment is decoupled from verified delivery and performance, brands carry all the downside risk while creators receive guaranteed upside.

This is one of the core structural flaws in traditional influencer workflows.

How Brands Traditionally Try to Reduce Risk

Historically, brands have attempted to reduce influencer payment risk through contracts, manual vetting, and post campaign audits.

Legal clauses related to authenticity, disclosure, and termination are common. Some brands tie partial payment to content delivery milestones. Others delay full payment until after posting.

While these approaches help on paper, they introduce friction, slow down campaigns, and still rely heavily on trust and manual enforcement.

Contracts alone do not prevent fraud. Manual vetting does not scale. And post payment disputes rarely end in the brand’s favor.

This is why more advanced brands are shifting from contract based protection to infrastructure based protection.

Escrow Payments as a Risk Reduction Layer

Influencer escrow payments fundamentally change how risk is distributed.

Instead of paying influencers upfront, funds are held securely until agreed deliverables are completed and approved. Payment is only released when conditions are met.

This approach mirrors how other performance based marketplaces operate and has proven effective in reducing disputes and fraud.

Research into influencer fraud mitigation highlights that escrow based payment structures significantly reduce wasted budget and improve trust between brands and creators.

By aligning payment with delivery, escrow removes the incentive for non compliance while maintaining fairness for legitimate creators.

The Role of Automation and Attribution in Payment Safety

Escrow alone is not enough without verification.

Brands need automated workflows that connect deliverables, approvals, and performance tracking to payment release. This ensures payments are tied not just to posting, but to real execution.

This is where influencer operations platforms become critical.

For Shopify brands in particular, integrating real time sales attribution into influencer workflows allows payments to be evaluated against actual revenue impact. This shifts influencer marketing from speculative spend to measurable performance.

For a deeper breakdown of how attribution transforms influencer campaigns, see our article Why Every Shopify Brand Needs an AI Attribution Layer.

Why Influencer Operations Reduce Risk at Scale

More creators, more campaigns, more manual steps, and more surface area for errors and fraud.

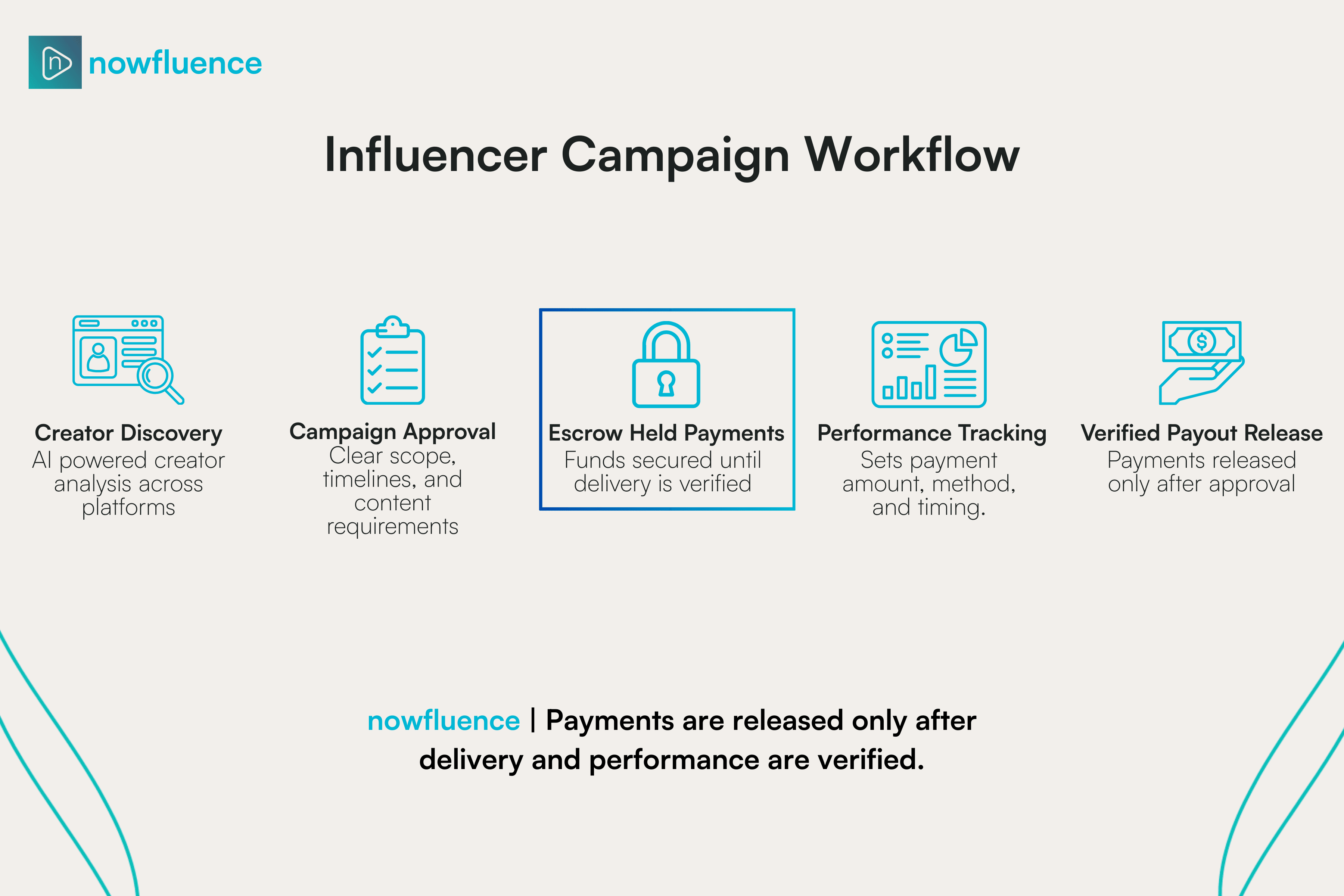

Influencer Operations introduces a centralized layer that manages discovery, workflows, approvals, attribution, and payments in one system. This eliminates spreadsheets, fragmented tools, and manual coordination that often cause payment disputes.

Brands that adopt an operations first approach see lower fraud exposure, faster campaign execution, and higher trust with creators.

This concept is explored in depth in Influencer Operations: The Missing Layer in Modern Marketing Teams.

Trust Is Built Through Systems, Not Promises

Consumer research consistently shows that influencer fraud erodes trust not just in creators, but in brands themselves.

Reducing payment risk is not about distrusting creators. It is about building systems that protect both sides and reward legitimate performance.

By combining escrow payments, automated workflows, real time attribution, and AI powered creator analysis, brands replace uncertainty with structure.

This shift is what allows influencer marketing to evolve from a risky experiment into a scalable growth channel.

For brands evaluating influencer spend versus other channels, our comparison in Influencer Marketing vs Paid Ads for Shopify: ROI Comparison provides additional context on why structured influencer programs outperform unmanaged campaigns.

Final Takeaway

Influencer payment risk is not a fringe issue. It is a core operational challenge.

Brands that continue relying on upfront payments, manual vetting, and post campaign enforcement will keep absorbing unnecessary risk.

Those that adopt escrow based payments, performance verification, and influencer operations infrastructure reduce fraud exposure while improving ROI and trust.

The future of influencer marketing belongs to brands that treat payments as a controlled process, not a leap of faith.

Want to discuss insights from this study? Reach out to our research team.